Executive Summary

This comprehensive report provides an in-depth analysis of the global stainless steel flange pipe fittings market as of May 2025. The industry continues to demonstrate strong growth momentum, driven by increasing demand from key end-use sectors including oil & gas, chemicals, petrochemicals, power generation, and construction. The market shows resilience and adaptation to evolving industrial requirements, with emphasis on high-performance materials and sustainable manufacturing practices.

Key findings indicate that the global stainless steel flanges market is positioned for sustained growth, with market size reaching significant milestones and technological advancements driving innovation across the value chain.

Chapter 1: Market Overview and Scope

1.1 Product Definition and Classification

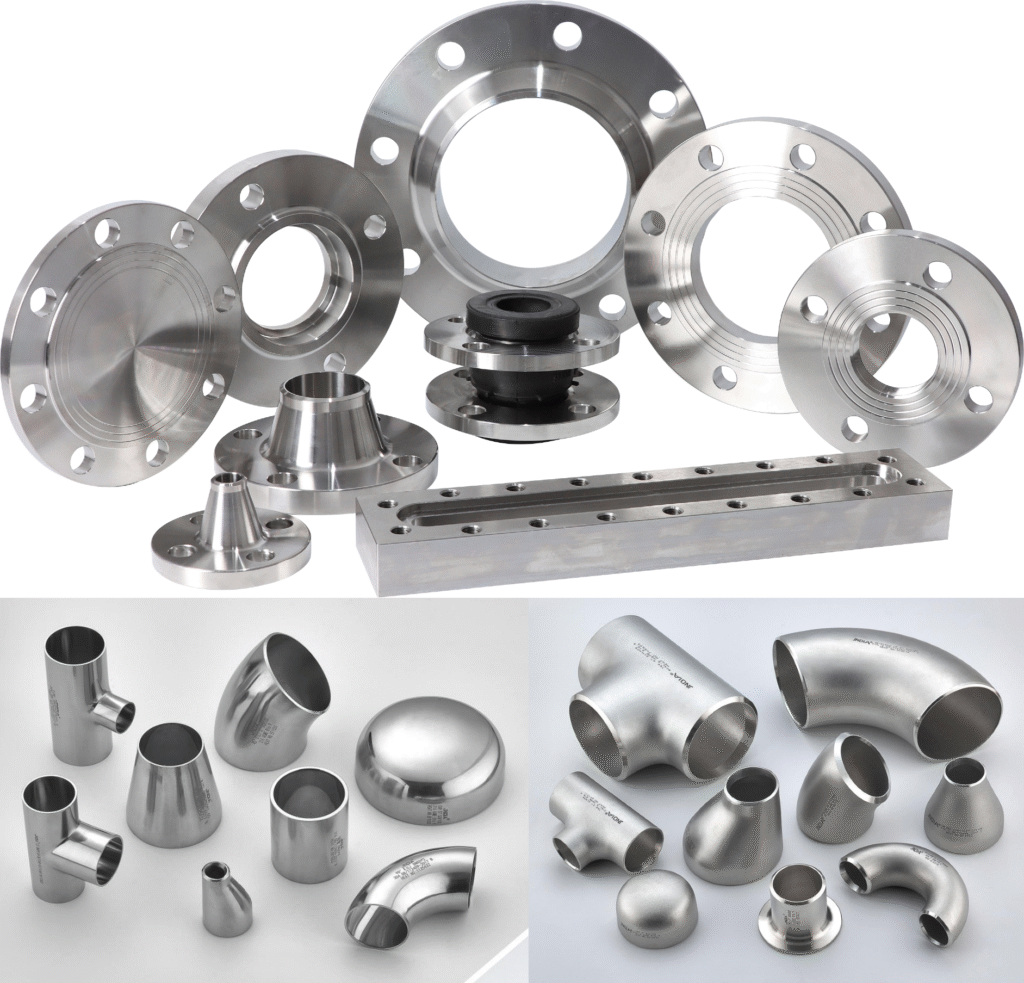

Stainless steel flange pipe fittings are critical components used in piping systems to connect pipes, valves, pumps, and other equipment. These fittings are manufactured from various grades of stainless steel, offering superior corrosion resistance, durability, and performance under extreme conditions.

Primary Product Categories:

- Weld Neck Flanges: Designed for high-pressure applications with full penetration welds

- Slip-On Flanges: Cost-effective solution for low-pressure applications

- Socket Weld Flanges: Ideal for small-bore piping systems

- Threaded Flanges: Used where welding is not feasible

- Blind Flanges: For closing pipe ends or vessel openings

- Lap Joint Flanges: Used with stub ends for easy disassembly

Material Grades:

- 304/304L Stainless Steel

- 316/316L Stainless Steel

- 321 Stainless Steel

- 347 Stainless Steel

- Duplex and Super Duplex Stainless Steel

1.2 Industry Applications

The stainless steel flange market serves diverse industrial sectors:

- Oil & Gas Industry: Upstream, midstream, and downstream operations

- Chemical & Petrochemical: Process equipment and piping systems

- Power Generation: Nuclear, thermal, and renewable energy plants

- Food & Pharmaceutical: Sanitary applications requiring high purity

- Water Treatment: Municipal and industrial water systems

- Construction: Architectural and structural applications

Chapter 2: Market Size and Growth Analysis

2.1 Global Market Valuation

The global stainless steel flanges market was estimated at USD 1.07 billion in 2024 and is projected to expand to USD 1.63 billion by 2033, growing at a CAGR of 4.84%. This growth trajectory reflects the increasing adoption of stainless steel materials across various industrial applications.

2.2 Broader Market Context

The stainless steel flange market operates within the larger pipe fittings and flanges ecosystem:

- The global flanges market is projected to reach $10.58 billion by 2031

- The global pipe fittings and flanges market was valued at approximately USD 15 billion in 2023 and is projected to reach USD 22 billion by 2032, growing at a CAGR of 4.2%

- The Stainless Steel Plumbing Pipes & Fittings Market is estimated at USD 5.09 billion in 2025, and is expected to reach USD 5.95 billion by 2030, at a CAGR of 3.19%

2.3 Regional Market Dynamics

The USA is anticipated to witness a CAGR of approximately 3.5% during the period 2025 to 2035, fueled by continued investment in oil and gas exploration, especially in shale formations, and infrastructure upgrades. China, India, Italy, and Germany are among the leading suppliers of flanges globally.

Chapter 3: Market Drivers and Growth Factors

3.1 Industrial Demand Drivers

The increasing demand from the petrochemical and food and pharmaceutical industries, which require corrosion-resistant materials, is a significant contributor to market growth. The preference for stainless steel flanges stems from their exceptional durability and resistance to harsh operating conditions.

3.2 Infrastructure Development

Rising infrastructure development and construction activities, particularly in rapidly developing economies in Asia-Pacific, are fueling market expansion. This trend is supported by increased government investments in industrial infrastructure and modernization projects.

3.3 Material Properties Advantage

Stainless steel holds the largest market share in 2023 among all materials for fittings and flanges due to its corrosion-resistant properties, containing 10% chromium. This inherent advantage positions stainless steel flanges as the preferred choice for critical applications.

Chapter 4: Competitive Landscape and Key Players

4.1 Major Market Participants

The global stainless steel flange market features several prominent manufacturers:

Leading International Companies:

- Outokumpu, Viraj Profiles Limited, Sandvik, Metalfar, AFGlobal, Bebitz, Melesi, Kofco, Core Pipe, Galperti Group, SBK, Maass Flange Corp, IPP Group

Key Market Players:

- AFG Holdings, Inc., Coastal Flange, Inc., Texas Flange, Simtech Process Systems, Outokumpu Armetal Stainless Pipe Co. Ltd, which accounted for 0.5-1% market share in 2023

4.2 Strategic Market Developments

Several key players in the flanges market are adopting expansion strategies across the globe. In June 2021, AFG Holdings Corporation’s subsidiary Ameriforge acquired Maass Flange, demonstrating the industry’s consolidation trend.

AFG Holdings, Inc. announced the acquisition of Maass Flange Corporation, a third-generation family company focused on alloy, stainless steel, and high nickel flange production, to offer products ranging from carbon and high yield to specialized alloys.

4.3 Market Concentration

The market exhibits moderate concentration with established players maintaining significant market share through technological innovation, quality assurance, and global distribution networks. The competitive landscape is characterized by both large multinational corporations and specialized regional manufacturers.

Chapter 5: Technology and Innovation Trends

5.1 Digital Manufacturing Integration

Companies are investing in digital manufacturing technologies and reskilling workforce to utilize digital solutions. Collaboration with technology vendors to incorporate IoT sensors for monitoring flange performance in real-time in end-use applications represents a significant technological advancement.

5.2 Material Science Advances

Ongoing research and development focus on:

- Enhanced corrosion resistance formulations

- Improved mechanical properties for extreme conditions

- Development of specialized alloys for specific applications

- Advanced manufacturing techniques for precision components

5.3 Quality and Performance Standards

The industry continues advancing quality standards through:

- Implementation of advanced testing protocols

- Certification compliance for international standards

- Traceability systems for material sourcing

- Environmental sustainability initiatives

Chapter 6: Application Sector Analysis

6.1 Oil & Gas Sector

The oil and gas industry remains the largest consumer of stainless steel flanges, driven by:

- Offshore drilling expansion

- Pipeline infrastructure development

- Refinery modernization projects

- Enhanced safety and environmental regulations

6.2 Chemical and Petrochemical Industry

The market is primarily driven by growing demand from the Petrochemical Industry, Food and Pharmaceutical Industry, and Architectural Decoration Industry. Chemical processing applications require high-performance materials capable of withstanding aggressive media.

6.3 Power Generation

The power generation sector shows increasing demand for stainless steel flanges in:

- Nuclear power plant construction and maintenance

- Renewable energy installations

- Combined cycle power plants

- Steam generation systems

6.4 Food and Pharmaceutical

Sanitary applications in food processing and pharmaceutical manufacturing require:

- FDA-compliant materials

- Easy cleaning and sterilization

- Contamination prevention

- Regulatory compliance

Chapter 7: Regional Market Analysis

7.1 Asia-Pacific Region

The Asia-Pacific region demonstrates the highest growth potential due to:

- Rapid industrialization in emerging economies

- Infrastructure development projects

- Manufacturing sector expansion

- Increasing energy demands

7.2 North American Market

The North American market shows steady growth supported by:

- Shale gas exploration activities

- Industrial infrastructure upgrades

- Stringent quality and safety standards

- Technological innovation adoption

7.3 European Market

Europe maintains a strong position through:

- Advanced manufacturing capabilities

- High-quality product standards

- Environmental regulations compliance

- Export-oriented production

7.4 Middle East and Africa

The MEA region presents opportunities in:

- Oil and gas sector investments

- Petrochemical industry expansion

- Infrastructure development projects

- Industrial diversification initiatives

Chapter 8: Market Challenges and Opportunities

8.1 Key Market Challenges

- Raw Material Price Volatility: Fluctuations in nickel and chromium prices impact production costs

- Supply Chain Disruptions: Global logistics challenges affecting material availability

- Quality Assurance: Maintaining consistent quality across different production facilities

- Environmental Regulations: Compliance with increasingly stringent environmental standards

8.2 Market Opportunities

- Emerging Markets Expansion: Growth potential in developing economies

- Technological Innovation: Advanced manufacturing processes and materials

- Sustainability Focus: Demand for environmentally friendly products

- Digitalization: Integration of digital technologies in manufacturing and supply chain

8.3 Strategic Recommendations

- Investment in research and development for advanced materials

- Expansion of production capacity in high-growth markets

- Implementation of digital manufacturing technologies

- Development of sustainable manufacturing practices

- Strategic partnerships and acquisitions for market expansion

Chapter 9: Future Market Outlook

9.1 Growth Projections

The stainless steel flange market is expected to maintain steady growth through 2030, supported by:

- Continued industrial expansion

- Infrastructure development projects

- Energy sector investments

- Technological advancement adoption

9.2 Emerging Trends

- Additive Manufacturing: 3D printing applications for complex geometries

- Smart Flanges: Integration of sensors and monitoring capabilities

- Sustainable Materials: Development of eco-friendly manufacturing processes

- Customization: Increased demand for application-specific solutions

9.3 Market Evolution

The industry is evolving toward:

- Higher performance standards

- Increased automation in manufacturing

- Enhanced quality control systems

- Global supply chain optimization

- Sustainable production practices

Conclusion

The stainless steel flange pipe fittings market demonstrates robust growth potential driven by industrial expansion, infrastructure development, and technological advancement. The market’s resilience and adaptation to changing industrial requirements position it favorably for sustained growth through 2030 and beyond.

Key success factors for market participants include technological innovation, quality excellence, global market presence, and strategic partnerships. Companies that invest in advanced manufacturing capabilities, maintain high quality standards, and develop sustainable practices will be best positioned to capitalize on emerging opportunities in this dynamic market.

The industry’s future depends on its ability to meet evolving customer requirements while maintaining cost competitiveness and environmental responsibility. Continued investment in research and development, coupled with strategic market expansion, will drive the next phase of growth in the stainless steel flange pipe fittings market.

This report is based on industry data and market research available as of May 2025. Market conditions and projections are subject to change based on economic factors, technological developments, and regulatory changes.